MISSOURI: THE LITTLE MARKET THAT COULD

Sometimes, the headlines really do say it all:

“ How Missouri Became a Cannabis Mecca ”

~ Wall Street Journal

“ Newcomer Missouri surpasses ‘weed capital’ Colorado in marijuana sales for 2024 ”

~ Springfield Daily News

“ Missouri’s $1.4 billion cannabis market outpaces states with older programs ”

~ Missouri Independent

“ Missouri marijuana sales tax revenue, $241 million in last 12 months, triples original estimate ”

~ KSHB, NBC KC

“ Missouri expunges nearly 100,000 marijuana convictions in year since constitutional amendment approved ”

~ KMBC

Since Missouri voters legalized adult-use marijuana in November 2022, no state has moved more efficiently and effectively to impact their state’s economy while creating thousands of jobs and generating hundreds of millions in tax revenues annually. Missouri’s $1.4 billion cannabis market has done more to bring consumers out of the shadows of the illicit market than any other state by providing Missouri patients and customers great access to high-quality, low-tax, lab-tested products.

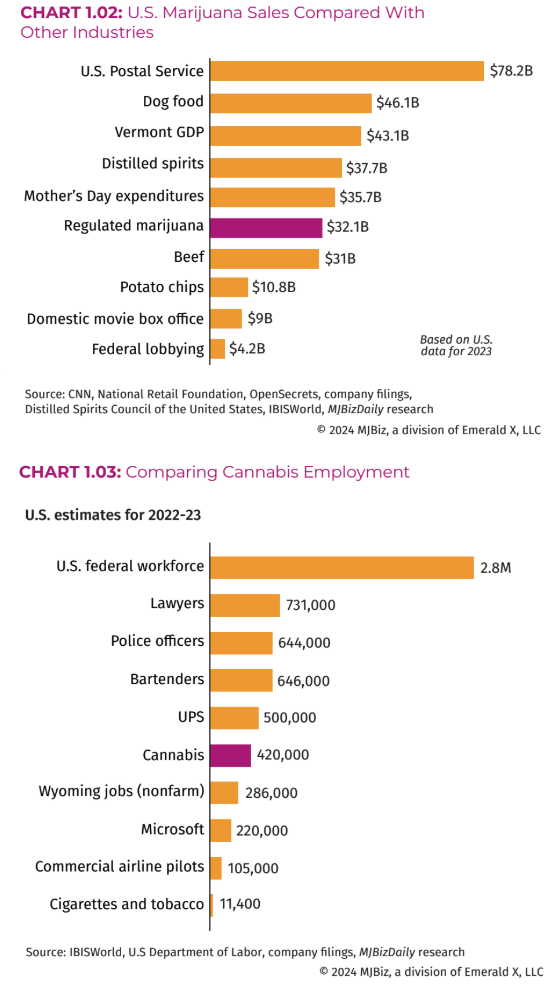

Jobs

In communities large and small, shuttered warehouses and closed manufacturing plants that long ago lost jobs overseas have now been retrofitted to cultivate and manufacture some of the finest cannabis grown in this country. Meanwhile, empty storefronts now are home to friendly dispensaries that employ some of the more than 20,000 Missourians now working directly in Missouri’s often-praised cannabis industry. And because 100% of the product is grown, manufactured, lab-tested, and sold in Missouri, the economic benefit stays in our local communities.

Tax Revenue to Vital State and Local Programs

While even today 56% of the cities and counties in California still ban adult-use sales, not a single community has done so here in Missouri. It’s no wonder why. Missouri’s cannabis industry now generates more than $241 million in sales tax revenue annually for state and local governments, with veterans, classrooms, substance abuse programs, and the state’s public defender system being the largest beneficiaries.

Righting Past Wrongs

Missouri has also automatically expunged more than 130,000 past, non-violent cannabis offenses from Missourians’ criminal records, becoming the first state to mandate automatic expungements by a vote of the people. In our economy’s tight labor market, not only are these second chances the right thing to do, but they also help foster economic growth.

A National Model

Missouri is regularly mentioned as one of the best cannabis markets, surpassing both a number of states with larger populations and states that legalized marijuana sooner.

Here are some key Missouri cannabis economic stats to consider:

Developments In The US Cannabis Industry in 2024 and Beyond

Excerpts taken from the Reuters article “Cannabis in 2024: a year in review”

By Alexander Malyshev and Sarah Ganley

US Cannabis Market Growth and Investment Surge

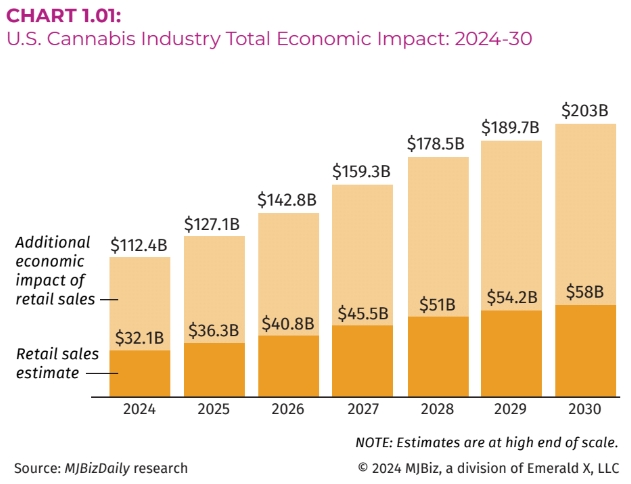

The U.S. cannabis market has had an impressive growth trajectory in 2024, with estimates suggesting it could reach $40 billion in sales by year-end. This growth is fueled by increased consumer demand, particularly in the states where cannabis has recently become legal.

While capital raises and M&A activity continued to be sluggish in 2024, experts expect a resurgence given perceived improved federal legalization prospects, state-level regulatory developments, and a more favorable capital market outlook. The industry is also becoming increasingly attractive to private equity and venture capital firms looking to capitalize on distressed assets and underperforming operators.

“All of this has been a welcome development for industry participants, many of whom, in previous years, have struggled with oversupply, low prices, and competition from the grey market. While many of these challenges still persist (especially in mature markets, such as California), 2024 offered hope that the industry remains robust and that growth opportunities will continue.”

The developments in the U.S. cannabis industry in 2024 reflect a significant shift towards acceptance and normalization. It remains to be seen if the trend continues under the second Trump administration in 2025. With federal legalization efforts gaining traction, states expanding access, advancements in research, and market growth, it is possible that the administration decides to stay the course. As the landscape continues to evolve, stakeholders should be prepared to respond to the emerging opportunities and challenges that will shape the industry's next chapter.

Alexander Malyshev and Sarah Ganley are regular, joint contributing columnists on legal issues in the cannabis industry for Reuters Legal News and Westlaw Today.

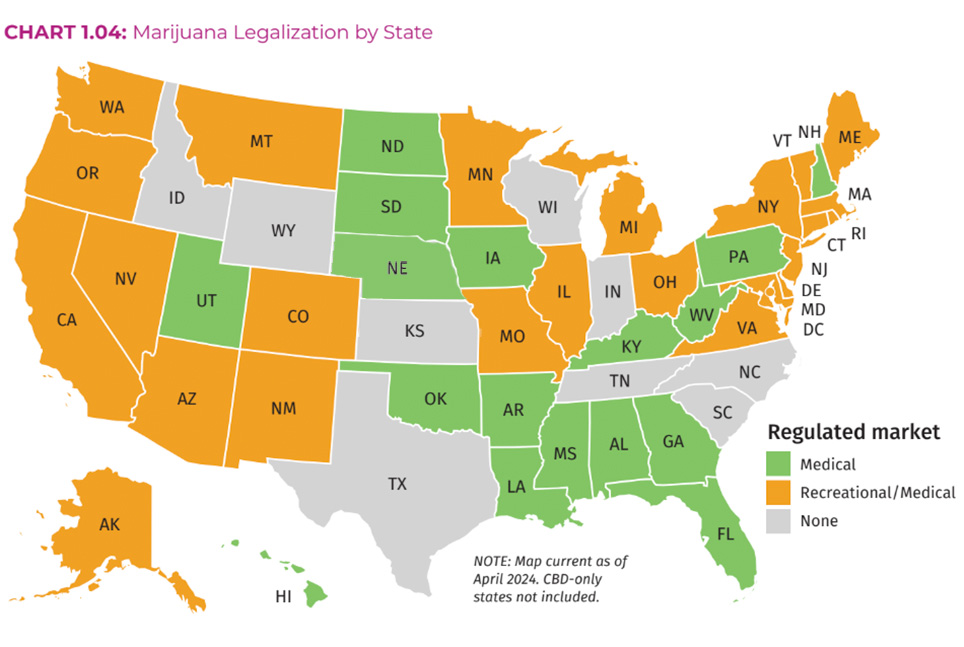

The Current Status Of Cannabis Legalization in the U.S.